90/10 Calculation and Disclosure and Other New Requirements Under Proprietary School Audit Guide

By Eileen Keller, CPA, Partner, Salmon Sims Thomas

A school or institution that participates in Title IV programs must have, at least annually, a compliance audit of its administration of Title IV funds, and an audit of its general purpose financial statements unless an allowable waiver has been granted.

In 2016 the U.S. Department of Education (“ED”) Office of Inspector General (“ED/OIG”) updated the audit guide related to financial statement and compliance audits of proprietary schools and compliance attestation engagement of third-party servicers that participate in ED’s student financial assistance (“SFA”) programs under Title IV of the Higher Education Act of 1965. The ED released the Guide for Audits of Proprietary Schools and for Compliance Attestation Engagements of Third-Party Servicers Administration Title IV Programs (“AG”) effective for institutions for fiscal years ending June 30, 2017, or later. Some of the significant changes outlined in the audit guide include the following:

- 90/10 calculation and disclosure

- Size of student sample tested

- Student confirmations

- Gainful employment

90/10 calculation and disclosure

The new AG focuses the auditor’s attention on testing the reliability and accuracy of the institution’s data, including evaluating the source documents. These changes impact both the institution and the independent auditor.

Institutions must determine the Title IV and non-Title IV revenue on a student-by-student basis.

Once the Title IV and non-Title IV funds are determined for each student, then the sum of funds are used to determine the numerator and denominator to arrive at the 90/10 ratio. In addition, the institution must separately disclose non-Title IV funds applied to current year and amounts applied to prior year charges.

The 90/10 ratio is based on the following methodology:

- Numerator = Net Title IV funds received

- Denominator = Total funds received, including revenue from activities and non-Title IV programs

It’s important to understand that the 90/10 calculation must be performed by the institution and cannot be performed by the independent auditor. Any misstatement must be disclosed as a finding, plus the auditor must disclose the nature of the misstatement and what they believe the resulting 90/10 ratio should be. Auditors are now auditing the institution’s student-by-student calculation and reporting any differences identified. If the school is unable to prepare the calculation, then it may engage a consultant to perform the calculation.

The information that is used for the student-by-student calculation includes the following for each student:

- Prior year ledger balance

- Total current year tuition, fees and other charges

- Funds received by source, i.e., Title IV and non-Title IV sources

For purposes of this article we have categorized funds as follows:

- Tier 1 – Funds that qualify as exceptions to the presumption rule

- Tier 2 – Net Title IV funds received

- Tier 3 – Cash payments from students, VA benefits, cash scholarships from third-parties, cash receipts from other outside sources

Title IV funds and non-Title IV funds for each student to be included in the 90/10 ratio is calculated as follows:

+ Prior year balance of tuition, fees and other institutional charges

+ Current year tuition, fees and other institutional charges

– Tier 1 funds received

– Tier 2 funds received

– Tier 3 funds received

The amount of funds will be applied in the prescribed only to the extent that the prior balance and current charges are satisfied.

Presumption rule – presumes that Title IV funds received will be used to pay tuition, fees, and other institutional charges regardless of whether or not the school credits the funds to the student’s account or pays the funds directly to the student (regardless of the chronological order in which the funds are received). There are exceptions to the presumption rule which allows certain funds to be applied to tuition and fees before Title IV funds. These exceptions include the following (referred to in this article as Tier 1 funds):

- Grant funds from non-federal public agencies (i.e., state grants, local government grants and private sources independent of the school)

- Funds provided under contractual arrangement with Federal, State or local government agencies for the purpose of providing job training of low-income individuals

- Funds from savings plans (i.e., 529 plans)

- Institutional scholarships (must be cash and not tuition credits/waivers)

Other allowable revenues to be included in the denominator of the 90/10 ratio include the following:

- Revenue from activities conducted by the school that are necessary for education and training

- Revenue from non-Title IV programs that meet certain criteria

- Institutional scholarships disbursed that meet certain criteria

The 90/10 calculation is based on the cash method of accounting and revenue is recognized when received rather than when earned.

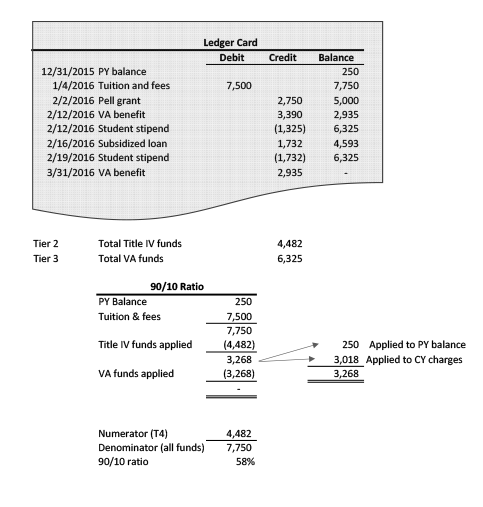

The following is an example of a student’s ledger card which includes a prior year ledger balance, current year tuition/fees and funds received by source:

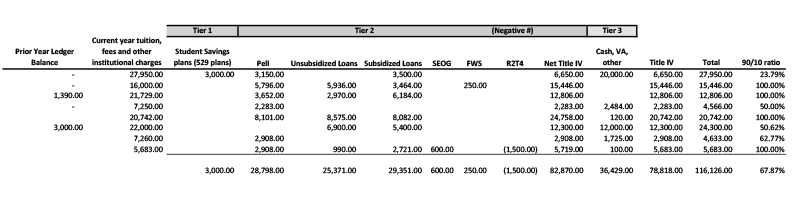

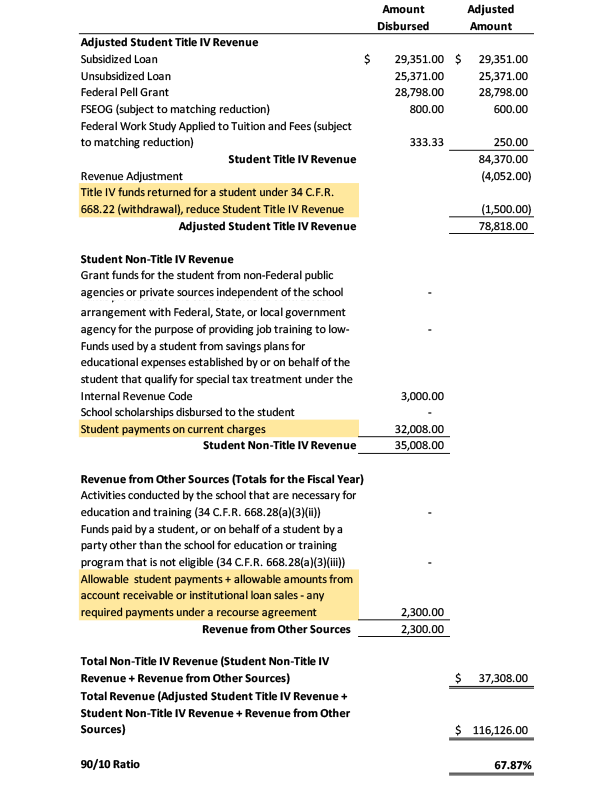

The following is a sample of a spreadsheet calculation on a student-by-student basis and the corresponding disclosure. The resulting totals of Title IV funds (numerator) and total funds (denominator) are used to arrive at an overall 90/10 ratio of 67.87 percent. The highlighted items on the disclosure are new or modified disclosure items per the new AG.

If the auditor determines that the school made an error in the 90/10 computation the auditor is now required to report this error as a finding in the Report on Internal Controls over Financial Reporting and Compliance and the auditor is required to provide information on the error. The following represents a sample finding:

The school’s 90/10 revenue percentage as disclosed in Note “x” is misstated due [state error]. Based on the results of our testing, we believe the correct amount should be [correct $ amount] and the 90/10 revenue percentage should be [xx.xx%].

Size of student sample tested

The new AG also includes modifications affecting the auditors’ compliance testing. The auditors are required to test the controls surrounding the administration of Title IV funding. The audit must be performed in accordance with U.S. generally accepted auditing standards (GAAS) and Generally Accepted Government Auditing Standards (GAGAS), commonly referred to as the “Yellow Book.” The significant change in the AG relates to the number of students that must be tested. The sample size for testing has been increased up to 60 percent, (maximum sample 120) and must include two populations of student data: active/graduates and withdrawn. The AG provides the following guidelines for testing:

| Universe | Sample |

|---|---|

| 250 Students or more | 60 Students |

| 100 to 249 Students | 25% of the Universe |

| 26 to 99 Students | 25 Students |

| 1 to 25 Students | 100% of the Universe |

The increase in the required sample size increases the amount of testing and potential findings by the auditor – which in turn may relate to higher audit fees.

Student confirmations

Based on the sample testing performed above, the auditors are required to confirmation 30 percent of information directly with the student. Positive, written confirmations should be sent via regular mail or email to verify existence that the student was enrolled/attended the school during the audit period, types of Title IV aid received and acknowledgment that consumer information was disclosed.

Gainful employment

In order to be eligible for Title IV student aid, programs offered at proprietary schools must lead to gainful employment. Institutions are required to annually report award year data for each program and for each student enrolled in a gainful employment program. The AG requires the auditor to test the student data submitted to ED for each student selected for testing in the student sample discussed above. The data that must be tested includes, but not limited to, the following:

- The name, Classification of Instructional Program (CIP) code, credential level, and length of program

- The date the student initially enrolled in the program

- The student’s attendance dates and attendance status in the program during the award year

- The student’s enrollment status as of the first day of the student’s enrollment in the program

- The date the student completed or withdrew from the program

- The total amount the student received from private education loans for enrollment in the program that the school is, or should reasonably be, aware of

- The total amount of school debt the student owes any party after completing or withdrawing from the program

- The total amount of tuition and fees assessed the student for the student’s entire enrollment in the program

- The total amount of the allowances for books, supplies, and equipment included in the student’s Title IV cost of attendance for each award year in which the student was enrolled in the program, or a higher amount if assessed the student by the school

Additionally, the AG requires the auditor to determine if all required program information was accurately reported for programs included on the school’s Eligibility and Certification Report (ECAR) and any programs added after the school’s last recertification.

As you can see, the changes made to the AG encompass a number of areas that affect schools and the independent audit firms. More testing will be performed by the auditor and auditors will request more documentation from the schools. For more information or assistance with any compliance areas discussed above, please contact us.

Eileen Keller has 25 years public accounting experience and is nationally known for her specialization in audit and accounting services for career schools and colleges. In addition to her role as partner, she serves as the firm’s director of career services overseeing the management of career school audit and engagements. Eileen enjoys helping clients manage the many financial and compliance-related issues they face every day.

Contact Information: Eileen Keller, CPA // Partner // Salmon Sims Thomas // 972-739-1265 // ekeller@sstccpa.com // sstcpa.com // Social media: LinkedIn: Eileen Keller, CPA